-

Consumer

-

Investing

- Investing basics

-

Deciding how to invest

-

Ethical investing

-

Managing your investment

- Online investing platforms

-

Types of investments

-

Bank regulatory capital

-

Binary options

-

Bonds

-

Cash investments

-

Crowdfunding

-

Cryptocurrencies

-

Derivatives

-

Exchange-traded funds

-

Foreign exchange trading

-

Gold and other commodities

-

Investment software packages and seminars

-

Managed funds

-

Peer-to-peer lending

-

Property investment

-

Property syndicates

-

Shares

-

Wholesale investments

-

Bank regulatory capital

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

-

Unregistered businesses

-

Investing

-

Finance professionals

-

Services

-

Accredited bodies

-

Administrators of financial benchmarks

- Auditors

-

Authorised body under a financial advice provider licence

-

Client money or property services provider

-

Climate Reporting Entities (CREs)

-

Crowdfunding service providers

-

Crypto asset service providers

-

Directors

-

Derivatives issuers

-

Discretionary Investment Management Service (DIMS)

- Financial advice provider

-

Financial adviser

- Financial Institutions

- Financial market infrastructures

-

Independent trustees

-

Interposed persons under the financial advice regime

- Managed investment scheme manager

-

Market operators

-

Offer disclosure for equity and debt offers

- Offers of financial products

-

Peer-to-peer lending service providers

-

Supervisors

-

Accredited bodies

- Focus areas

- Legislation

-

Licensed & reporting entities

-

Online Services

-

Services

-

About

- People & leadership

-

Board

- Regulatory approach

- Enforcing the law

-

Investor capability

-

Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

-

When to contact us

-

Make a complaint

-

Official Information Act (OIA) requests

-

Make a protected disclosure (whistleblowing)

-

When to contact us

28 January 2022

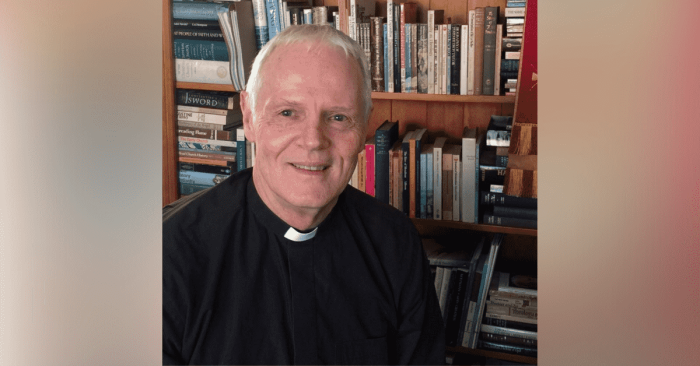

FMA investor profile - Reverend Scott Malcolm

Our ongoing series of monthly profiles of investors around New Zealand. This month, we talk to Rev Scott Malcolm, an Anglican Priest.

“A little over a long time adds up.”

61-year-old Scott Malcolm has spent his life serving Christ, earning a modest income as a Baptist Minister, a Probation Officer, a Prison Chaplain and more recently as an Anglican Priest. A father of four and a grandfather of six, Scott says his secure financial position later in life has been the result of regular contributions adding up over time.

“Neither I nor my wife have ever been high income earners, so our thing has been to make regular contributions to everything we have invested in. A little over a long time adds up. On the odd occasion when we have had larger sums of money come in, we have always chosen to invest that rather than spend it.”

The couple’s current investments include an apartment (classified as an investment property as the couple live in a church vicarage), contributions to the Anglican church pension fund, KiwiSaver and managed funds.

Scott favours “easy” investments. “Managed or passive funds are great. Experts do all the work, pay the tax, and you get the benefit. Simple. I find being a landlord stressful, even when you have the most lovely tenants which we have always had. “

He says the best investment advice he’s ever had is “don’t be greedy – if it sounds too good to be true it probably is.”

Scott decides how to invest by reading up, particularly on preparing for retirement.

"Not anything too technical, but almost anything I have been able to find on retirement. How much is needed, how long it's going to last, what people spend, how they budget. All that kind of stuff. I have also asked as many people as I can who have already retired what their experience is like. The Massey University yearly survey is always helpful as is Mary Holm."

“The Aussies have done a lot of work on what’s needed for a good retirement too. One of my daughters-in-law also has a friend who works as a financial adviser for a very respectable money management firm and a chat with her at a party and then again in her office was very, very helpful.”

While Scott dabbled in investments like gold and a building society in the 80s none of it “lasted very long.”

“It really gathered some pace when I joined the Superannuation Fund when I started working for the Baptist Church, in the very late 80’s. As that grew, I began to realise it worked.”

Like many people, turning 50 made the concept of retirement very real. “Being able to retire with a nest egg has been the motivation for all of what we have done since, in terms of investing.”

Scott describes himself as a ‘long-term strategist’ – but wishes he’d started earlier. “If you make sensible investment decisions, time is the most important thing you need.”

What does he do to mitigate risk? “Not have all of our eggs in one basket, either with the kind of investments we have or the risk profile. At our age it’s good to have some safe places just in case, as well as some risky ones so that things keep growing (hopefully!).”

*The views and opinions expressed above are those of the interviewee and do not necessarily reflect the views or official position of the FMA.

Useful links

FMA investor resources:

Other investor profiles: