-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

Page last updated: 13 October 2021

Misleading advertising of investment products

It’s prohibited for companies making investment offers to mislead or deceive you.

You are entitled to accurate information when companies advertise – and they can’t withhold important information about the investment. Look out for things like advertisements promoting high returns with little explanation of the risks.

Advertising of investment products

Many financial companies advertise directly to consumers with investment opportunities, for example, KiwiSaver, managed funds, debt securities such as term deposits or bonds, share offers or other investments products. You might have spotted these on TV, on social media or in the newspaper.

Firms must ensure advertisements for financial products are not misleading, deceptive or confusing. Many different aspects can contribute to an advertisement being misleading, deceptive, or confusing including specific claims or statements, the presentation and format and imagery used, important information being buried in fine print, or what an advertisement does not say.

Even an advertisement that is factually correct may not meet the required standards if it creates an overall impression that is misleading, deceptive or confusing. This applies to all types of advertising: websites, TV, radio, social media, emails, newspapers, magazines, billboards, buses, presentations and seminars, and even sponsored content from influencers and celebrities.

What to look out for

A large range and variety of investment offers are advertised, and they have a range of different levels of potential return and risk - not all investment options are likely to be suitable for you. If an advertisement for a financial offer catches your eye (or ear), ask yourself:

- Does the advertisement present a balanced view of the investment? What are they not saying?

- What does the advertisement say (or not say) about the risk of the investment? Words such as ‘secured’, ‘certain’, ‘stable’, ‘guaranteed’ can give the impression that an investment is of low or no risk – this can be misleading if the investment is not low risk. Similarly, advertisements of higher risk investments do not always state that they are higher risk.

- If the firm is promising a certain rate of return, what is the basis for this? Is it based on reasonable methodology and assumptions, and are these clearly explained?

- Are they promoting the product based on previous good performance? If so, does the advertisement make it clear that past performance is not a guarantee of future returns? Past performance should not be the most prominent feature. What other information is provided?

- Are any warnings or disclaimers clear?

- Are they comparing their offer to another product? Or claiming to be the best or a leader? Is it a fair claim or comparison, e.g. is the comparison with the same type of product, timeframe, level of risk and/or underlying investments? Do you have enough information to tell?

Wholesale investments

Some investment opportunities are only available to wholesale investors.

Sometimes wholesale investments are advertised in places where retail investors (also called ‘everyday’ or ‘Mum and Dad’ investors) will see them. However, these ads must make it clear that they are available for wholesale investors only.

We recommend less experienced investors stay clear of wholesale investments, even if they are able to meet the wholesale investor criteria. That’s because wholesale investments are designed for sophisticated investors with the necessary resources and understanding of the nature and risks of the investment.

If you are considering a wholesale investment offer, you should seek professional financial advice from a financial adviser and make sure you fully understand the risks and consequences before signing up and handing over your money.

How to spot a dodgy ad

If you’ve seen an advertisement for an investment product you think is misleading, deceptive or confusing, or looks like a scam, let us know. The more information you can give us the better – details of when and where you saw it, links, screenshots or images, and what you think is wrong with the advertisement will help us look into it.

If you think the advertisement is socially irresponsible, please contact the Advertising Standards Authority. If you’ve seen an advertisement for a consumer credit contract you think is misleading, deceptive or confusing, please contact the Commerce Commission.

If the FMA finds an advertisement is misleading, deceptive or confusing, we can require the advertiser to amend or remove it, or even take court action if we think the misconduct is serious enough.

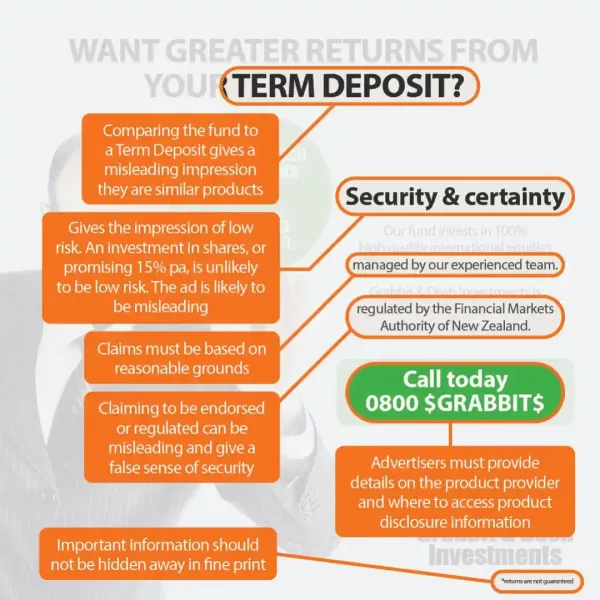

Can you spot the six elements in this "ad" that are likely to be misleading?

We've highlighted in orange below the warning signs of this "ad":

Unregulated investments like cryptocurrencies

The FMA monitors misleading advertising for regulated investment products. We have less oversight over unregulated investments.

Other agencies, such as the Commerce Commission, regulate broader fair-trading requirements that cover other financial products or services.

Unregulated investments like direct investing in cryptocurrencies have a range of risks including misleading advertising or even being scams.