-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

Page last updated: 22 January 2024

Financial Institution licensing

Any registered bank, licensed insurer, or licensed non-bank deposit taker in the business of providing one or more relevant services will need to hold a financial institution licence to continue operating, if that service is received by a consumer in New Zealand.

This means a financial institution that is in New Zealand but only provides relevant services or associated products to consumers outside New Zealand will not need to hold or operate under a financial institution licence.

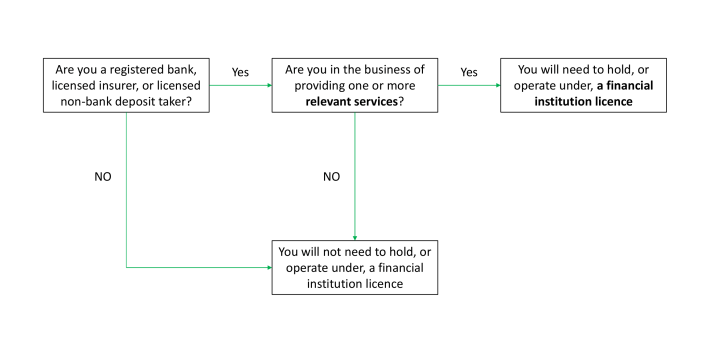

The following diagram is a useful tool you can use to determine whether you require a financial institution licence.

8-steps to apply for a Financial Institution licence

The CoFI Act requires financial institutions to be licensed to continue providing relevant services to consumers. Before you apply for a licence, we recommend you follow the following 8 steps:

STEP 1:

Decide if you need to apply for a financial insititution licence

Registered banks, licensed insurers and licensed non-bank deposit takers need to determine if they will require a financial institution licence.

STEP 2:

See what questions we'll ask

Get familiar with the financial institution licence application guide and review the application questions.

STEP 3:

Prepare your fair conduct programme

You will need to have established your fair conduct programme (FCP) prior to applying for a financial institution licence.

STEP 4:

Get the basic admin done

Log in to the FSPR on the Companies Office website and select the “Financial Institution - licensed” service. You’ll need to do this at least 24 hours before you start your draft application online.

STEP 5:

Log in to the application portal

STEP 6:

Start your draft application

We won’t see any of your answers until you press SUBMIT. Complete as much as you can, then save a draft and come back and finish the job when you’re ready.

STEP 7:

Seek further help if you need it

Your success is important to us. Please get in touch if you have questions on the licencing process. Contact the FMA or talk to your professional advisers about what might be helpful for you.

STEP 8:

Press submit!

Congratulations on finishing your application. We’ll be in touch soon to advise the outcome.

Licensing costs

The basic licensing fee payable to apply for a financial institution licence is $1,024.93 (incl. GST).

We may charge an additional fee where the time to assess a licence application exceeds 6.75 hours, as set by the Financial Markets Conduct (Fees) Regulations 2014. For an FMA staff member this is set at $178.25 per hour, or part-hour pro rata, of work carried out. Please refer to the regulations for further information.

If an additional fee will be incurred for your application, we will notify you in advance, including the reason why.

The fee for each authorised body included in the financial institution licence is $614.95.

Applications to vary conditions on an existing licence will incur an application fee of $115 plus $178.25 per hour, or part-hour pro rata, of work carried out.

Please refer to the Financial Markets Conduct (Fees) Regulations 2014 for more information.

All amounts are GST inclusive.

This payment is to apply for a financial institution licence; it does not include any annual levies, or fees to register on the Financial Service Providers Register

Useful links

- 8 steps to apply for a financial institution licence

- Standard conditions for financial institution licence

- Licensing FAQs

- Fair Conduct Programme (FCP)

- Fair Conduct Programme information for smaller firms

- Quick link to the FMA online services for licensing

- CoFI intermediated distribution guidance

- Sales incentives and other regulations