-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

Page last updated: 04 October 2018

Managed funds

Managed funds enable you to invest in different types of assets, even if you don’t know much about investing. KiwiSaver schemes are managed funds.

When you invest in a managed fund, your money is pooled with other investors’ money and is spread across different kinds of investments. A manager chooses how the fund is invested according to the rules set out for each fund and each investor owns a proportion of the total fund. You can invest in a single fund or a mix of funds.

Guide to Managed Funds

If you’re just getting started with investing, the first step is to identify your investment goals, timeline, strategy and investor type, including the level of risk you’re willing to take.

Managed funds are a popular choice for investors who don’t want to spend a lot of time managing their investments. They allow you to outsource parts – or all – of your portfolio to a suitably qualified expert who pools individual investments into a larger investment fund and manages that money.

You can select a fund that matches the level of risk you’re comfortable with, or invests in the type of assets you’re interested in. If this sounds appealing, our guide will help you get started.

Unlike a bank term deposit, the return you get from a managed fund will go up and down over time, depending on what it’s investing in.

Growth assets typically have higher long-term returns

‘Growth’ or ‘aggressive’ funds investing in higher-risk assets such as shares and property may be more volatile, but over time they typically provide a higher return. ‘Defensive’, ‘conservative’ or ‘balanced’ funds mostly invest in lower-risk assets such as bonds and cash. They are likely to have more stable returns but not likely to grow as much over the long term.

Below is an example of the return you might receive from managed funds. (Source, Investor KickStarter).

|

Type of fund |

Range of annual returns you might have |

Expected average annual return (before fees and taxes have been deducted) |

|

Aggressive |

-9.0% to 27.0% |

7.5% |

|

Growth |

-6.3% to 21.4% |

6.7% |

|

Balanced |

-3.6% to 16.4% |

5.9% |

|

Conservative |

-1.4% to 11.9% |

5.0% |

|

Defensive |

-0.7% to 10.2% |

4.6% |

For up to date details about average returns go to Sorted’s Smart Investor.

Different funds have different return benchmarks

The best way to assess return is to compare it to a relevant benchmark. With managed funds, the fund manager chooses a market index to act as a benchmark. An active fund aims to beat the market index return, but they don’t always manage to achieve that goal. A passive fund simply tracks a market index.

Managed funds are regulated investments. We license the fund manager and their supervisor and we monitor they’re meeting the minimum standards required by law. But there are still risks to think about.

Funds with more growth assets will have higher volatility

Growth assets like property and shares go up and down in value more frequently than income assets like cash and bonds. Different funds have different mixes of growth and income assets.

You can't always access your money easily

Some managed funds allow you to sell your units daily, while others have less frequent options. You may also have to give notice. This can be days or weeks. For KiwiSaver funds, your money is locked in until the age of eligibility for NZ Superannuation (currently 65), with some exceptions.

Funds operated from overseas may have tax or currency risks

Investors in New Zealand may be able to invest in overseas managed funds through the Asia Region Funds Passport arrangement. This arrangement simplifies cross-border marketing of managed funds across certain countries in the Asia Pacific region.

It aims to create a regional market for collective investment schemes, making cross-border offerings easier across Australia, Japan, Republic of Korea, New Zealand and Thailand.

Under this arrangement, funds are registered in their home country, but follow the same set of agreed rules as other passport funds registered in New Zealand. New Zealand investors may benefit from the broader and more diverse fund offerings but should take tax advice and be aware of currency differences.

If you invest in any passport funds, you should receive an information sheet and a Product Disclosure Statement (PDS) to provide you with information about the organisation offering the fund, where it was registered, and any fees and charges payable.

Fees can have a big impact on your total returns over the long term. It’s worth comparing fees from more than one manager before you invest. Smart Investor shows the average fees for different types of funds.

Management fees are usually shown as percentages

You’ll pay a management fee which is usually calculated as a percentage of the fund’s net assets.

Be aware that small percentage differences can mask how much impact fees have in actual dollar terms. Use an online calculator, or ask your provider to help you work out the dollar amount you will pay in fees.

Other fees may also apply

Other fees may include:

- Performance-based fees – for achieving a return that’s better than the target return

- Other charges such as administration or member fees

- One-off charges such as exit fees

- Fees charged by a financial adviser

Active funds are usually more expensive

Active funds (that aim to outperform an index), tend to be more expensive than passive funds (that track an index) because they require more management and investment expertise.

PIE funds have lower tax rates

Portfolio Investment Entity (PIE) funds are a type of managed fund offered by banks that offer investors lower tax rates. There’s usually a penalty for accessing your money early, or in some cases, early access m

All managed funds have a Product Disclosure Statement (PDS). Reading the PDS will help you:

Find out the asset mix

The PDS will give you a breakdown of the types of assets in each fund. Don’t just go by the fund name. A conservative fund from one provider might have a different mix to a conservative fund from another provider. Note, the PDS won’t tell you the exact investments as this varies over time but you can find this out on Smart Investor.

Check the experience of your fund manager

Their success depends on their skill at choosing investments, particularly for actively managed funds, and knowing when to buy and sell. It can be a warning sign if a fund has a high turnover of managers.

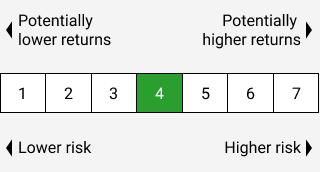

Check the risk indicator

The risk indicator is a standardized measure of how likely the fund’s value will be to go up and down over time. Generally, if a fund invests in more growth assets, the risk indicator will get higher when markets are more volatile. Funds with a higher proportion of income assets will generally have a lower risk indicator.

Check the specific risks for this fund

The PDS spells out any risks specific for a given fund. For example, a fund that only invests in a certain market sector is at risk of low or negative returns if that sector fails.

Review your managed fund investments at least once a year using the various reports your provider must publish. Even if you have an investment adviser, it’s important you read them yourself.

Check your fund update

Each quarter (or at least once a year), your fund manager will publish a fund update. This information will help you keep track of your investment and will include:

- the fund’s risk indicator (how likely it is to go up and down in value)

- returns over the past five years compared to a relevant market index

- the fees charged in the year to date

- how the fund was actually invested compared to the intended mix

- the top 10 investments that make up the fund.

Fund updates follow a standard format so you can easily compare the risk, return and fees of your fund to other similar funds. You’ll find fund updates on your provider’s website.

Read the annual report

All managed funds must give you a copy of their annual report, or a link to it on their website, within six months of the end of their financial year.

The annual report describes any changes made to the scheme in the last year, how it’s being managed, how investments have performed against the scheme’s goals, and if the auditor has raised any concerns.

We’ve created a guide to help investors find their way around annual reports. It explains what to look out for in the financial statements, what certain terms mean, and the red flags which may crop up.

You can request other information at any time

For example:

- an estimate of your balance

- the amount of fees you have paid

- full financial statements and any audit report*

- a copy of the most recent PDS*

- a copy of the Statement of Investment Policy and Objectives (SIPO)*

*These documents can also be found on Smart Investor