-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

Page last updated: 05 October 2022

Ethical finance

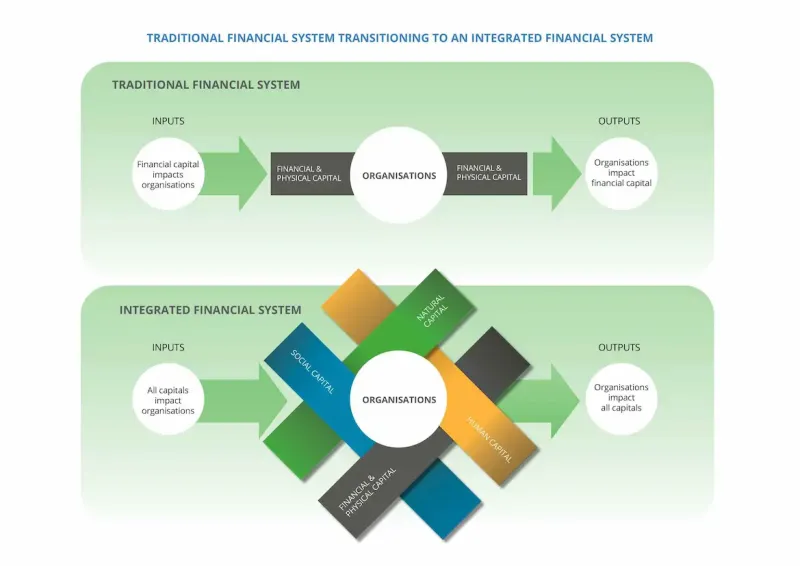

The FMA supports New Zealand’s transition to an integrated financial system – one that looks beyond financial returns to also consider non-financial factors.

An integrated financial system will require organisations to take account of their impacts on the environment, communities, and individuals, alongside traditional financial considerations. And also how these factors impact their organisation, including its financial performance.

There is growing demand for organisations to identify their natural, social and human capital risks and opportunities, and to disclose how these will affect their financial performance. This is the concept behind the widely recognised Environmental, Social and Governance (ESG), and Climate-Related Disclosures (CRD) frameworks.

At the same time, demand for integrated investment products is rising, with heightened interest in products that either exclude investments associated with negative impacts, or fund those associated with positive impacts. These typically take one of two forms: securities such as ‘green bonds’ which often fund specific projects, or ethical or responsible managed funds, including some KiwiSaver schemes.

As demand for integrated financial products grows, we want to ensure that investors can be confident these products deliver what they promise, and that investors are protected from poor product design and misleading promotion such as ‘greenwashing’.

The FMA’s use of the term ‘integrated financial system’ reflects that other related terms do not have a commonly shared meaning and are not as widely inclusive. This includes the terms ‘ethical’, ‘responsible’, ‘sustainable’, ‘green’, ‘impact’, and ‘ESG’.

The Treasury’s Living Standards Framework describes these non-financial factors as natural, social, and human capitals (in addition to traditional financial and physical capital).

In line with other financial markets conduct regulator, we are supporting the transition through our focus on disclosure; fair dealing and investor capability.

Working within our existing remit to facilitate and encourage boards and directors to identify, consider and adequately disclose the impact of natural, social and human capital risks and opportunities, such as climate change as a foreseeable financial risk and opportunity. This may be achieved, for example, through monitoring and regulating disclosure obligations including financial and non-financial reporting and for regulated offers.

For listed issuers, this includes our work in relation to continuous disclosure and other NZX obligations, such as the obligation for non-financial information (e.g. ESG factors) to be disclosed in annual reports.

In the future, this is likely to also include mandatory 'Climate-Related Disclosures' for listed issuers and significant fund managers.

Ensuring that funding and investment products with natural, social and human capital features – such as green bonds and responsible investment funds – "do what they say on the tin", i.e. that they do what they say in their marketing and other disclosures.

The FMA will proactively monitor and address any misleading or confusing advertising or disclosure in respect of integrated financial products.

This fair dealing focus will take into account the overall impression presented to the investor.

FMA’s intent

As a risk-based regulator, the FMA identifies risks and responds accordingly, to minimise harm to investors, the financial sector and the economy.

We intend to support the transition to an integrated financial system by

- promoting and facilitating market development;

- promoting trust and confidence in capital markets; and

- Supporting informed investor decision making.

We know that many financial sector entities are well advanced in their consideration of natural, social and human capital impacts. As change accelerates, one of our key roles is to support the transition by providing clarity and guidance on what we expect of financial sector entities.

We are working closely with local agencies to ensure a coordinated approach, while also keeping pace with latest international thinking via our relationships with our peer regulators offshore.

While the FMA alone cannot achieve meaningful progress on global challenges associated with natural, social and human capital impacts – such as climate change and social inequality – we do have the ability to drive change across the financial system within our existing remit.

FMA’s work plan

We look forward to working with stakeholders across the financial sector, to address the challenges and opportunities presented by the transition to an integrated financial system.

Consultation

While the FMA alone cannot achieve meaningful progress on global challenges associated with natural, social and human capital impacts – such as climate change and social inequality – we do have the ability to drive change across the financial system within our existing remit.

Guidance

Following this consultation, we published:

Disclosure framework for integrated financial products' guidance – to help ensure issuers and fund managers deliver on their promises to investors.

an updated information sheet 'Green Bonds – same class exclusion' to clarify whether the same class exclusion is available for quoted vanilla bonds that have undergone a 'greening' process.

Default KiwiSaver schemes

From 2021, Default KiwiSaver Schemes will be required to take account of Environmental, Social and Governance (ESG) factors prescribed by the Government. This will include publishing ESG policies, and accounting for ESG investment activities.

See the announcement on the Beehive website: Default KiwiSaver changes support more responsible investment

The FMA will be responsible for monitoring providers’ compliance with these new requirements.

Climate-related disclosure

New Zealand is the first country to commit to developing and imposing new reporting standards based on the principles set by the Task Force on Climate-Related Disclosures.

These standards will outline how organisations should inform stakeholders of the risks and opportunities they face related to climate change.

Information about the mandatory climate-related disclosures is available on MBIE’s website and you can also track the progress of the bill.

Once the External Reporting Board (XRB) has developed the relevant standards and guidelines, the FMA will likely be responsible for monitoring and enforcing organisations’ disclosures, in line with the standards.

The FMA will continue to work closely with other agencies in New Zealand and internationally to support cross-agency co-ordination and keep pace with new developments.

We will also continue to provide policy advice to the Government regarding the development of an integrated financial system.

* The Treasury’s Living Standards Framework describes these non-financial factors as natural, social, and human capitals (in addition to traditional financial and physical capital).