-

Consumer

-

Investing

- Investing basics

-

Deciding how to invest

-

Ethical investing

-

Managing your investment

- Online investing platforms

-

Types of investments

-

Bank regulatory capital

-

Binary options

-

Bonds

-

Cash investments

-

Crowdfunding

-

Cryptocurrencies

-

Derivatives

-

Exchange-traded funds

-

Foreign exchange trading

-

Gold and other commodities

-

Investment software packages and seminars

-

Managed funds

-

Peer-to-peer lending

-

Property investment

-

Property syndicates

-

Shares

-

Wholesale investments

-

Bank regulatory capital

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

-

Unregistered businesses

-

Investing

-

Finance professionals

-

Services

-

Accredited bodies

-

Administrators of financial benchmarks

- Auditors

-

Authorised body under a financial advice provider licence

-

Client money or property services provider

-

Climate Reporting Entities (CREs)

-

Crowdfunding service providers

-

Crypto asset service providers

-

Directors

-

Derivatives issuers

-

Discretionary Investment Management Service (DIMS)

- Financial advice provider

-

Financial adviser

- Financial Institutions

- Financial market infrastructures

-

Independent trustees

-

Interposed persons under the financial advice regime

- Managed investment scheme manager

-

Market operators

-

Offer disclosure for equity and debt offers

- Offers of financial products

-

Peer-to-peer lending service providers

-

Supervisors

-

Accredited bodies

- Focus areas

- Legislation

-

Licensed & reporting entities

-

Online Services

-

Services

-

About

- People & leadership

-

Board

- Regulatory approach

- Enforcing the law

-

Investor capability

-

Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

-

When to contact us

-

Make a complaint

-

Official Information Act (OIA) requests

-

Make a protected disclosure (whistleblowing)

-

When to contact us

20 September 2023

KiwiSaver Annual Report

The FMA publishes a report every year based on all providers’ statutory data for the year to the end of March. It summarises our activities as a regulator relating to KiwiSaver during the previous financial year.

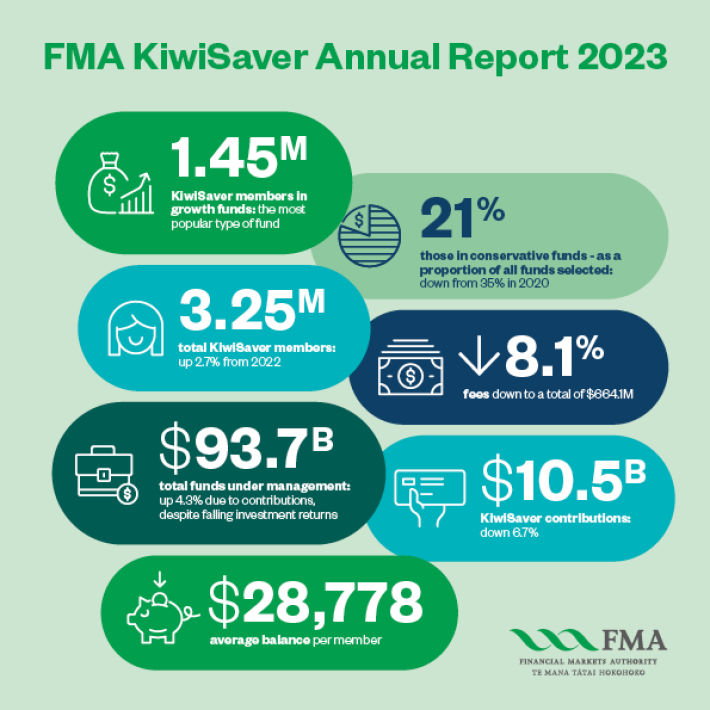

KiwiSaver Annual Report 2023: A year when contributions proved more important than investment returns.

KiwiSaver held firm in its sixteenth year as markets continued to experience significant volatility in the year to end of March 2023.

Total funds under management rose $4 billion or 4.3% to $93.7 billion, despite negative investment returns. This growth largely came from contributions from members, employers and the Crown, demonstrating the importance of regular contributions to KiwiSaver. Contributions make the biggest difference to KiwiSaver balances, followed by fund choices.

Growth funds are now the most popular fund choice as people become more comfortable with the long-term nature of KiwiSaver and more are making active choices. Last year’s changes to default settings – from Conservative to Balanced funds – also contributed to the shift toward growth funds.

For the first time in KiwiSaver history, fees didn’t rise, but rather fell by 8%. This was due to the combined effect of lower default fund fees along with some providers removing their membership fees, and others not earning the same level of performance fee as they might have in previous years.

This year also saw over-65s withdraw more than $2.8 billion from KiwiSaver – an increase of 46% on last year. This could have been a response to market volatility and the changing interest rate environment with an increase money in returns term deposits. While withdrawals were up, a large majority of people over 65 are keeping their money in KiwiSaver.

627 KB

Highlights from the KiwiSaver Annual Report 2023 (infographic)

Related

- KiwiSaver annual report 2022

- KiwiSaver annual report 2021

- KiwiSaver annual report 2020

- KiwiSaver annual report 2019

- KiwiSaver annual report 2018

- KiwiSaver annual report 2017

- KiwiSaver annual report 2016

- KiwiSaver annual report 2015

- KiwiSaver annual report 2014

- KiwiSaver annual report 2013

- KiwiSaver annual report 2012

- KiwiSaver annual report 2011