-

Consumer

-

Investing

- Investing basics

-

Deciding how to invest

-

Ethical investing

-

Managing your investment

- Online investing platforms

-

Types of investments

-

Bank regulatory capital

-

Binary options

-

Bonds

-

Cash investments

-

Crowdfunding

-

Cryptocurrencies

-

Derivatives

-

Exchange-traded funds

-

Foreign exchange trading

-

Gold and other commodities

-

Investment software packages and seminars

-

Managed funds

-

Peer-to-peer lending

-

Property investment

-

Property syndicates

-

Shares

-

Wholesale investments

-

Bank regulatory capital

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

-

Unregistered businesses

-

Investing

-

Finance professionals

-

Services

-

Accredited bodies

-

Administrators of financial benchmarks

- Auditors

-

Authorised body under a financial advice provider licence

-

Client money or property services provider

-

Climate Reporting Entities (CREs)

-

Crowdfunding service providers

-

Crypto asset service providers

-

Directors

-

Derivatives issuers

-

Discretionary Investment Management Service (DIMS)

- Financial advice provider

-

Financial adviser

- Financial Institutions

- Financial market infrastructures

-

Independent trustees

-

Interposed persons under the financial advice regime

- Managed investment scheme manager

-

Market operators

-

Offer disclosure for equity and debt offers

- Offers of financial products

-

Peer-to-peer lending service providers

-

Supervisors

-

Accredited bodies

- Focus areas

- Legislation

-

Licensed & reporting entities

-

Online Services

-

Services

-

About

- People & leadership

-

Board

- Regulatory approach

- Enforcing the law

-

Investor capability

-

Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

-

When to contact us

-

Make a complaint

-

Official Information Act (OIA) requests

-

Make a protected disclosure (whistleblowing)

-

When to contact us

22 September 2021

Don’t freak out if markets go down

If you’ve ever opened your investing app to a sea of red down arrows and felt a surge of panic, you’re not alone. Having an emotional reaction and a desire to do something - anything - to stop the fall is actually hard-wired into our brains as humans.

It’s called loss aversion, and behavioural scientists have run experiments showing we’re almost twice as likely to fear losses as we are to enjoy gains.

Financial markets can be volatile with share prices based on demand which can fluctuate day to day, or even minute to minute. Here’s some tips to avoid making knee-jerk decisions which may not be in your best interests when markets go down.

Shares or funds – what’s right for me?

Investing directly in individual shares is great if you have time to do research or if you want to learn about investing. But another option could be investing in a basket of shares via a managed fund or an exchange-traded fund (ETF) where the experts choose the individual investments for you based on their own research. This also helps take the emotion out of your investment decisions.

Be clear about when you need the money

Our research shows most people have a fairly generalised goal - “to grow my money” - when it comes to investing. So it’s no wonder we worry when our money stops growing.

It’s helpful to think about what you need the money for and when. If you don’t need the money straight away, you can afford to wait out any market dips and wait for your investment to recover. If your goal is shorter-term, you might want to think about lower-risk investments with lower volatility.

Remember, it’s time in the market that matters

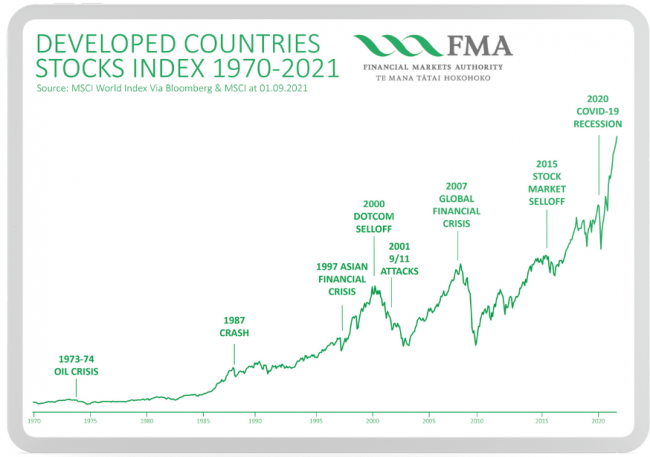

History has shown that investments in the sharemarket have grown more over the long term (10 years or more) than almost any other type of investment. Even severe market crashes associated with the GFC in 2007 or the Wall Street crash of 1929 were followed by periods of significant recovery in share prices. Providing you don’t need the money immediately, often the best course of action is to do nothing and wait for the market to recover over time.

Diversify

We’ve got a whole other ‘Daily D’ on this one but it’s worth re-stating. Having a mix of asset classes and, within your asset classes, exposure to different sectors and different countries, means a fall in one area is likely to be offset by gains, or at least stability in others. Even if one company or investment in your portfolio fails, having a mix of other investments will cushion any losses.

First think about diversifying across asset classes, which means cash, shares, fixed interest and property. Then move on to diversify within these asset classes, so you’re not just owning shares in one industry or one country, for instance.

Get some advice

One of the best ways to manage emotions when markets are falling is to talk to someone else. Choose an experienced person you trust or, better yet, work with a professional financial adviser who’ll be able to remind you of your goals and say whether making changes will be in your best interest.

Remember that the sea of voices on social media are not your best source of advice. If you think some are valid, stick to using those ideas as a jumping-off point for doing your own research.