-

Consumer

-

Investing

- Investing basics

-

Deciding how to invest

-

Ethical investing

-

Managing your investment

- Online investing platforms

-

Types of investments

-

Bank regulatory capital

-

Binary options

-

Bonds

-

Cash investments

-

Crowdfunding

-

Cryptocurrencies

-

Derivatives

-

Exchange-traded funds

-

Foreign exchange trading

-

Gold and other commodities

-

Investment software packages and seminars

-

Managed funds

-

Peer-to-peer lending

-

Property investment

-

Property syndicates

-

Shares

-

Wholesale investments

-

Bank regulatory capital

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

-

Unregistered businesses

-

Investing

-

Finance professionals

-

Services

-

Accredited bodies

-

Administrators of financial benchmarks

- Auditors

-

Authorised body under a financial advice provider licence

-

Client money or property services provider

-

Climate Reporting Entities (CREs)

-

Crowdfunding service providers

-

Crypto asset service providers

-

Directors

-

Derivatives issuers

-

Discretionary Investment Management Service (DIMS)

- Financial advice provider

-

Financial adviser

- Financial Institutions

- Financial market infrastructures

-

Independent trustees

-

Interposed persons under the financial advice regime

- Managed investment scheme manager

-

Market operators

-

Offer disclosure for equity and debt offers

- Offers of financial products

-

Peer-to-peer lending service providers

-

Supervisors

-

Accredited bodies

- Focus areas

- Legislation

-

Licensed & reporting entities

-

Online Services

-

Services

-

About

- People & leadership

-

Board

- Regulatory approach

- Enforcing the law

-

Investor capability

-

Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

-

When to contact us

-

Make a complaint

-

Official Information Act (OIA) requests

-

Make a protected disclosure (whistleblowing)

-

When to contact us

Page last updated: 10 March 2023

Financial Services Legislation Amendment Act 2019 (FSLAA)

The laws governing financial advice in New Zealand have changed.

On 15 March 2021, the Financial Markets Conduct Act 2013 was amended by the Financial Services Legislation Amendment Act 2019, introducing a new framework for giving financial advice.

Known as the financial advice regime, the framework changed how we regulate financial advice in New Zealand. The changes are designed to:

- Ensure the conduct and client-care obligations of financial service providers remain fit for purpose

- Allow financial advice to be provided online as well as in person

- Set industry-wide standards for conduct and competence.

The Financial Services Legislation Amendment Act introduces changes to ensure the conduct and client-care obligations of financial service providers and the regulation of financial markets remain fit for purpose. It also addresses misuse of the financial service providers register by offshore entities. The changes are designed to:

- remove regulatory boundaries, such as the adviser classifications (AFA, RFA, and QFE), the distinction between ‘class advice’ and ‘personalised advice’ and category 1 and 2 products

- allow financial advice to be provided online as well as in person

- set industry-wide standards for conduct and competence

Legislation

The Financial Services Legislation Act 2019 passed into law in April 2019, repealing the Financial Advisers Act 2008 on 15 March 2021. The Financial Markets Conduct Act 2013, (as amended by the Financial Services Legislation Amendment Act 2019), sets out the duties that now apply to providers and individuals.

Licensing

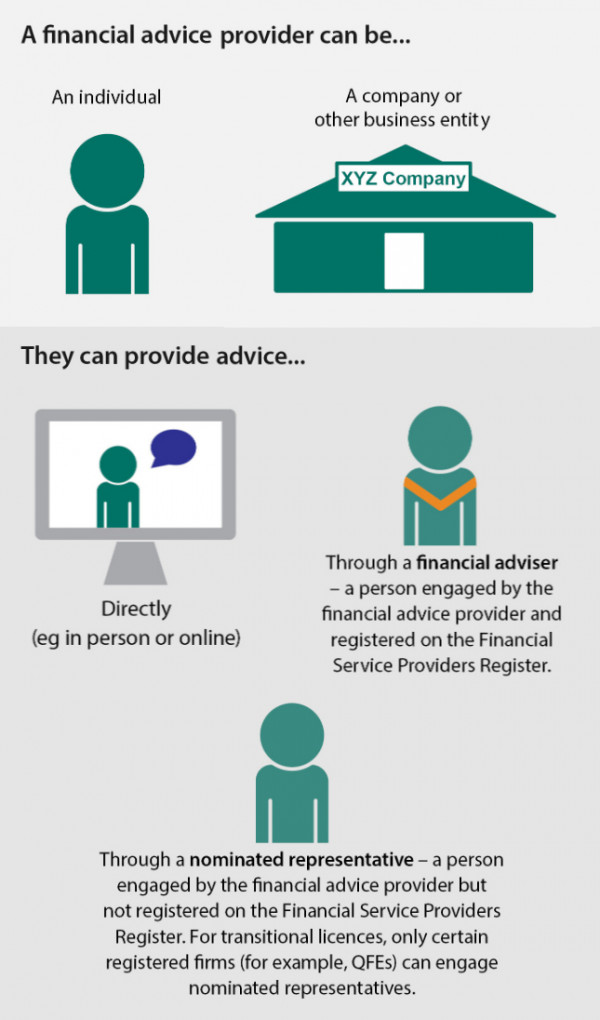

To give financial advice to retail clients, individuals must now either hold a Financial Advice Provider (FAP) licence or be engaged to operate under a Financial Advice Provider’s licence as a Financial Adviser or Nominated Representative.

- You will need a licence if you want to be a financial advice provider (FAP) and provide advice on your own account to your own clients – for example, you run your own business.

- You won't need a licence if you want to be a financial adviser or nominated representative who provides advice on behalf of another financial advice provider.

Ways to operate under the regime

We have provided information about 5 different ways you can operate under the new regime. These are the more straightforward ways you can operate going forward. They don’t cover all possible options – for example, more complex business arrangements (including authorised bodies) or those mostly applying to larger organisations are not included.

- Providing advice on behalf of someone else

- Single adviser business

- Business or individual with financial advisers

- Business with financial advisers and nominated representatives

- Business with nominated representatives

Registration

To address misuse of the Financial Service Providers Register (FSPR), you will only be able to register as a financial service provider if you are providing services to New Zealand clients. This requirement aims to improve client confidence and protect New Zealand’s good business reputation both at home and abroad.

Standard conditions

Financial advice provider licences are subject to seven standard conditions, as well as conditions imposed by the FMC Act, the regulations, and any specific conditions imposed by the FMA.

Code of Conduct

Anyone providing advice to retail clients is subject to a new Code of Professional Conduct for financial advice services. This outlines the standards of conduct, client care, competence, knowledge, and skill you need to meet when providing financial advice in New Zealand.

Disclosure requirements

You must disclose certain information to your clients to ensure they can make informed decisions.

A number of Government Agencies are involved in the implementation and oversight of the Financial Services Legislation Amendment Act 2019 (FSLAA):

Financial Markets Authority

- Provides information on regulatory requirements, like guidance about the licensing application process

- Assesses and issues licences for financial advice providers

- Collects data, and monitors compliance and outcomes through ongoing supervision

- Takes enforcement action when needed.

Ministry of Business, Innovation and Employment

Considers and recommends regulations containing technical details to support the legislation. This includes:

- the disclosure requirements for those providing financial advice; and

- setting fees and ongoing levies.

New Zealand Companies Office

Registers relevant firms and individuals on the Financial Service Providers Register (FSPR).

Code Committee

- An independent group appointed by the Minister of Commerce and Consumer Affairs to prepare the Code of Professional Conduct for financial advice services.

- This sets out minimum standards of conduct, client care, competence, knowledge and skill.

- Reviews and recommends changes to the Financial Advice Code.

- You will need a licence if you want to be a financial advice provider (FAP) and provide advice on your own account to your own clients – for example, you run your own business. Read our Introductory guide to full licensing requirements to find out more about how to complete your online application and what we ask for.

- You won't need a licence if you want to be a financial adviser or nominated representative who provides advice on behalf of another financial advice provider.

There are two steps to applying for a Financial Advice Provider licence:

- Login to the FSPR on the Companies Office website and register for the Financial Advice Provider full licence service*. Make sure you register in the name of your company if it’s your company that will hold the licence. (* If you’re applying for a FAP full licence the relevant service on the register is “Financial advice provider – licensee – full licence”)

- Once your registration on the FSPR has updated apply on the FMA licensing portal.

- Apply now.

Want more detail?