-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

17 June 2021

High level of KiwiSaver switching during COVID-19 driven by young people

Media Release

MR No. 2021 – 24

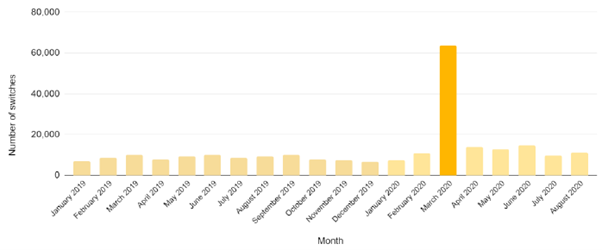

Young people dominated the high level of KiwiSaver fund switching during the height of COVID-19 market volatility last year, KiwiSaver provider data shows.

Research commissioned by the Financial Markets Authority (FMA) – Te Mana Tātai Hokohoko – has revealed KiwiSaver members aged 26-35 made five times more fund switches than usual, while overall fund switching was three times higher than the normal volume.

PwC compared and analysed fund switching data of 1.5 million KiwiSaver members from seven KiwiSaver providers – representing around half all KiwiSaver accounts. Switching data from February to April 2020 was compared to the same period in 2019.

The report found 58,356 of the sample KiwiSaver members made 88,112 switches, meaning some made multiple switches. These switching members represented 3.9% of the total sample - 2.7 times higher than the same group in 2019.

The report contains a number of future considerations for providers, including highlighting the risks of switching funds, improving the measurement of investor communication effectiveness, utilising prompts to have members pause before completing a switch, and following up with anyone who switched to ensure they were comfortable with their decision and the consequences for the long-term. The FMA will discuss the findings and implications with providers to explore potential improvements.

Other key findings from the sample members included:

- March 2020 was the peak switching month, with seven times the 2019 average monthly volume

- On 22 March 2020 there were 6,156 switches – the equivalent of around 20 days’ worth of switches in 2019

- 70.5% of switches were to lower risk funds, 11% to equivalent risk funds and 18.5% to higher risk funds

- Members aged 26 to 35 constituted 23% of all sample members, yet made 30.8% of all lower risk fund switches

- Banks saw a disproportionate increase in switching compared to other KiwiSaver providers

The FMA commissioned the research to understand the extent of and reasons for fund switching behaviour during the high level of market volatility, through a behavioural science lens.

Gillian Boyes, FMA Manager – Investor Capability, said the report has focused predominantly on the behaviour of younger KiwiSavers because this is where the most switching occurred.

“Using behavioural science, we can observe a bias among younger people to take action when they see their balances drop. Younger people with a bank KiwiSaver provider often see their balance alongside day-to-day accounts. The research found this may be influencing younger people to see their KiwiSaver as both accessible and transactional like a bank account. This was supported with a small number of case studies we interviewed – all three said they switched funds after seeing their balance drop and they found the process straightforward,” Ms Boyes said.

“Action bias means people felt the need to 'do something' to gain a sense of control over their falling balance, other factors provoking this activity were emotionally-charged public conversations about KiwiSaver at the time, a herd mentality, and a desire to mitigate short-term losses. A panic decision to switch because of shorter term events can have long term consequences.”

Ms Boyes said it was concerning that only 9.1% of people who switched to a lower risk fund from February to April 2020 ‘boomeranged’ back to a high growth fund by August. This meant a large portion of those who left growth funds would now be in a low-risk fund that may not align with their savings goals, especially if they were a long way from retirement.

The report acknowledges all participating KiwiSaver providers increased their investor communications during the COVID-19 market volatility, however there remain important considerations for KiwiSaver managers to help members make informed decisions in future market turbulence.

Total number of fund switches per month

Timeline of market value and fund switches

Download Lockdown: A review of KiwiSaver member behaviour in response to COVID-19 PDF

Download KiwiSaver Switching Behaviour: KiwiSaver Member Stories PDF

ENDS

Media contacts:

Andrew Park

FMA Media Relations Manager

[email protected]

021 220 6770

Campbell Gibson

FMA Senior Adviser, Media Relations

[email protected]

021 945 323