-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

11 July 2022

Spotlight on: Compound interest

The story goes that Albert Einstein once called compound interest the eighth wonder of the world, saying “He who understands it, earns it; he who doesn't, pays it”. Whether or not those are actually his words, it’s true that compound interest is a powerful effect of investing that, over time, will get your money working for you.

When you invest money in a product such as a term deposit or managed fund, you are (in simple terms) lending your money to someone who will use it to (hopefully!) make more money. Interest is money paid to you by a borrower in return for you lending your money.

Depending on the terms of your investment, when interest is paid out, it may be added to the overall sum you have invested. This gives the interest the opportunity to compound, which basically means you earn interest on that interest.

For example

You invest $10,000 in a product that offers a fixed return of 4% per year (for the purposes of this example, calculated annually, and after fees and tax). At the end of the year, you will receive $400 in interest – 4% of $10,000.

You keep in the entire $10,400 in the investment. At the end of the second year, you receive $416. That is 4% on your original investment, and also 4% on the interest you earned last year – for a total of $10,816. That $16 is compound interest.

Compound interest is for the long term

An extra $16 doesn’t sound like much. But the real value of compound interest is over the long term.

If you kept the above example invested for 10 years, by the end you would have $14,802 – your original $10,000, $4000 from interest, and $802 from interest on the interest.

Now imagine you made additional contributions to the investment each month or year, or kept the money invested for even longer (the amount of time you might save for retirement, for example). You can start to get an idea of how the increases grow.

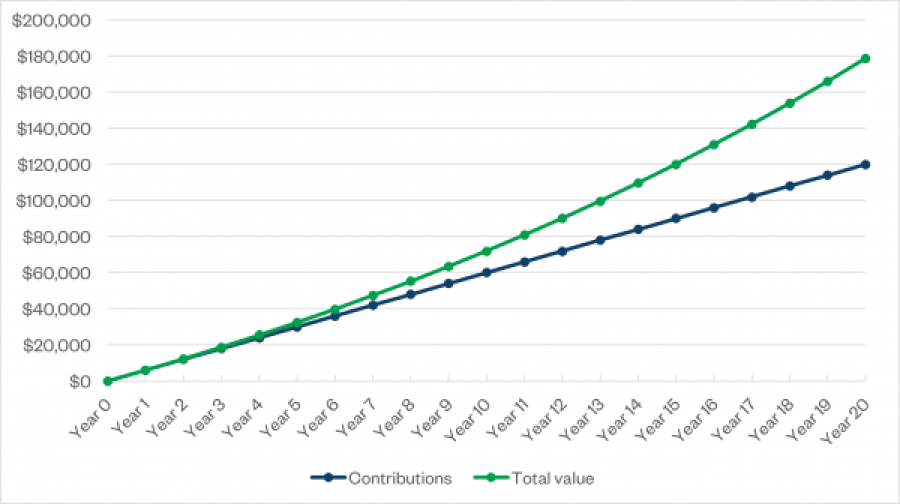

Here’s an example for visual learners:

The graph shows someone investing $500 per month for 20 years, and earning a fixed rate of 4% interest per year. Notice the total value line slopes up ever more sharply than the contributions? Think of that steeper angle as compound interest at work, providing returns on the returns, while the amount contributed stays the same.

Time is obviously the key factor. The longer you’re invested, the further apart the lines get. So, the sooner you get started, the greater the benefits will be.

The compounding effect is the same for investment products like managed funds, with returns rather than interest. However, as returns are based on the value of the fund’s underlying investments, the total value of the investment may fluctuate as markets rise and fall.

KiwiSaver uses the benefit of compounding returns. Because you cannot access your money until you turn 65, returns automatically become part of your investment, and instantly start generating returns themselves.

The Savings Calculator on sorted.org.nz lets you plug in your own numbers to see how compound interest could play a part in your savings goals.

Compounding is a side effect

Remember, compounding interest or returns aren’t a product or separate feature. They’re the effect of reinvesting your investment returns. It becomes part of your overall investment, and therefore subject to the same returns and risks. If the market dips and the value of your KiwiSaver investment drops, that drop applies to your total investment – your contributions and the returns earned.

See other FMA pages on: