-

Consumer

-

Investing

- Investing basics

- Deciding how to invest

- Ethical investing

- Managing your investment

- Online investing platforms

-

Types of investments

- Bank regulatory capital

- Binary options

- Bonds

- Cash investments

- Crowdfunding

- Cryptocurrencies

- Derivatives

- Exchange-traded funds

- Foreign exchange trading

- Gold and other commodities

- Investment software packages and seminars

- Managed funds

- Peer-to-peer lending

- Property investment

- Property syndicates

- Shares

- Wholesale investments

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

- Unregistered businesses

-

Investing

-

Finance professionals

-

Services

- Accredited bodies

- Administrators of financial benchmarks

- Auditors

- Authorised body under a financial advice provider licence

- Client money or property services provider

- Climate Reporting Entities (CREs)

- Crowdfunding service providers

- Crypto asset service providers

- Directors

- Derivatives issuers

- Discretionary Investment Management Service (DIMS)

- e-money and payment service providers

- Financial advice provider

- Financial adviser

-

Financial Institutions

- Financial Institution licensing

- Fair Conduct Programme

- Financial institution licensing FAQs

- Sales incentive FAQs

- Financial institution regulatory returns

- FMA letter sent to entities licensed under the Conduct of Financial Institutions regime (CoFI)

- FMA Letter to Insurers Regarding Incentive Structures and Fair Conduct Obligations

- Financial market infrastructures

- Independent trustees

- Interposed persons under the financial advice regime

- Managed investment scheme manager

- Market operators

- Offer disclosure for equity and debt offers

- Offers of financial products

- Peer-to-peer lending service providers

- Supervisors

- Focus areas

- Legislation

- Licensed & reporting entities

- Online Services

-

Services

- myFMA Document library

-

About

- People & leadership

- Board

- Regulatory approach

- Enforcing the law

- Investor capability

- Corporate publications

- News & Insights Document library

- Scams Document library

- Careers Document library

-

Contact

- When to contact us

- Make a complaint

- Official Information Act (OIA) requests

- Make a protected disclosure (whistleblowing)

- Frequently asked questions

05 December 2022

How to identify a product disclosure statement (PDS) or prospectus scam

Can you spot the hallmarks of a fake product disclosure statement (PDS) or prospectus? The FMA is warning investors to be vigilant after seeing an increase in fake investment documents targeting New Zealand investors, an example of how scammers can tailor their approach.

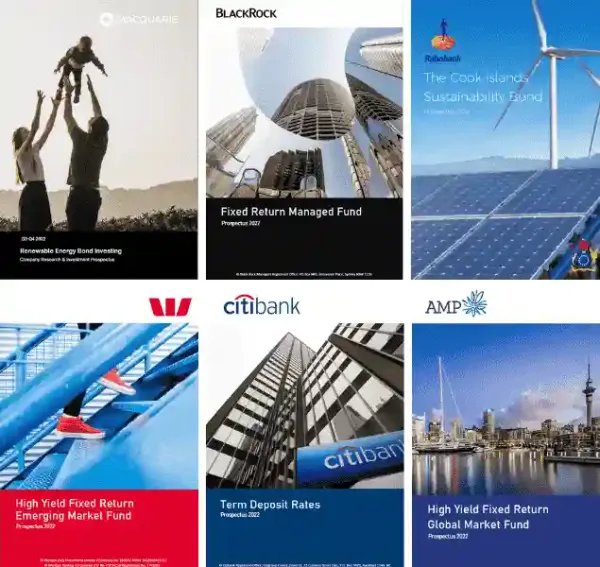

The scammers are using the branding and imagery of well-known and reputable New Zealand and international financial institutions, such as banks and fund managers, to build credibility. The FMA issued a warning about an investment issued in the name of Blackrock Investment Management Australia Limited and AMP Capital and another warning about a phony Rabobank Sustainability Bond prospectus in November 2022.

The FMA has noted these fake documents mainly imitate PDSs for managed funds and are inconsistent with PDS legal requirements. The fake documents follow a similar format, as shown below.

| Scam PDS format | Required PDS format for managed funds* |

|

|

*NOTE: These sections are required by regulation for a managed fund PDS and must be headed up, ordered and numbered sequentially.

Other financial products, such as bonds and shares, have different PDS requirements to managed funds.

Remember scammers may improve and evolve their approach to be consistent with a legitimate PDS. Be sure to follow the advice on our Scam basics page.

Known scam PDS or prospectus documents

The FMA is aware of fake PDSs or prospectuses purporting to be from the below financial services firms, offering bonds or funds. It is possible and likely other businesses are being impersonated.

- AMP ‘High Yield Fixed Return Global Market Fund Prospectus 2022'

- Blackrock ‘Fixed Return Managed Fund Prospectus 2022'

- Rabobank ‘The Cook Islands Sustainability Bond Prospectus 2022'

- Citibank ‘Term Deposit Rates Prospectus 2022'

- Westpac ‘High Yield Fixed Return Emerging Market Fund Prospectus 2022'

- Macquarie ‘Renewable Energy Bond Investing Company Research & Investment Prospectus Q3-Q4 2022'

- Macquarie ‘Fixed Income Green Sustainability Bond Product’ 2022

Providers have been alerted their brands were being misappropriated and have published warnings on their websites to steer investors away from these scams.

What makes a PDS scam dangerous?

Scams of this nature can be more convincing as they use the real details of a business - such as an image of its Chief Executive and its Financial Service Providers Register or Companies Office Register number.

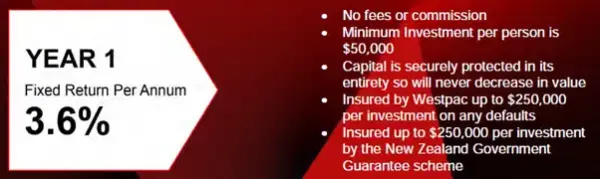

Investors are asked to hand over large sums of money, often more than $50,000.

Instead of being cold called in the traditional sense, we understand investors have inadvertently navigated to a term deposit comparison website operated by the scammers. Investors are invited to enter their contact details and then receive a follow-up call or email from a scammer claiming to be from a legitimate firm. The scammer can be well-spoken and familiar with the legitimate firm's products and services.

The forecast returns can be within a reasonable range and can involve traditionally safer financial products (e.g. term deposits or bonds), unlike other scams that make 'get rich quick' promises to lure investors.

How to avoid being scammed

The simplest way to avoid this type of scam is to contact the legitimate provider directly and ask if a document is genuine. Navigate to the provider’s website by typing their name in a search engine and ensure you click on a trusted link (look for a green padlock next to the URL) or ring their phone number. Do not use the contact details provided to you in the document or accompanying documents, as these could be fake.

Investors can also check that a PDS or prospectus is available on a provider’s website or and - if it is a managed fund for retail investors - on the Sorted Smart Investor tool.

Carefully check the bank account you are being asked to deposit funds into. Be wary if it’s an offshore account as most legitimate providers will have New Zealand bank accounts and ensure the name of the account is consistent with the provider's name.

If you are still not sure, seek financial advice from a financial adviser before investing.

Red flags

Familliarise yourself with examples of sophisticated and sometimes subtle red flags listed below.

Despite these documents being more sophisticated than other types of scams, some of the usual red flags are still present:

Scammers often use terms such as “fixed” income or returns and “no risk of capital loss” to make the scheme more attractive.

Example 1

There is no risk of capital loss to the client. It is capital protected, asset backed and regulated in its entirety by Rabobank and the Financial Markets Authority (FMA).

- fake Rabobank PDS

Example 2

Fixed income refers to the guarantee that regardless of the fund performance the client will get the fixed rate of return. Historically the fund has outperformed the dividend given to the clients and this excess, over and above the fixed rate of return is kept in its entirety by the bank.

- fake AMP PDS

Scammers might say the investment is protected or guaranteed by the Government or Financial Markets Authority, and misappropriate logos or branding. The FMA never guarantees any investment.

Example 1

Is the return Guaranteed? Yes, it is fixed, so regardless of market conditions or economic situations like COVID-19, Russia’s invasion of Ukraine or an inevitable incoming recession, you will still get the rate of return outlined in this prospectus regardless of what happens. Your Fixed Rate Bond is more of a loan with a coupon fixed rate of return rather than an investment.

fake Rabobank PDS

Example 2

Image of fake Macquarie PDS

A genuine PDS uses clear language to explain the product and only contains essential information to help you decide whether to invest. Scammers might use vague, unsubstantiated, or irrelevant statements to make their scheme more attractive. A fake PDS might also contain poor grammar or spelling mistakes.

Example 1

We understand that last year was not the greatest year to achieve financial freedom and a lot of clients focus on capital preservation, with low-risk strategies a favourite to maintain their capital.

We have been working hard on creating this Fixed Return managed Fund to ensure safety and security, but also address the situation of a healthy market beating rate of return.

This fund has been created with both of these key factors in mind. It comes with the highest level of corporate governance and security, being asset backed and insured to a government level and has the latest technology and emerging sectors to maximise growth in a secure manner.

Let's ensure 2022 is a year in which we beat inflation and get our savings working harder for us.

-fake BlackRock PDS

Example 2

The company protect the investment up to $250,000 per investment. This is because the asset management company is a regulated entity. Complying in full to the terms of the New Zealand Financial Markets Authority (FMA). The term deposit rates within this investment are also covered by the Australian Government up to $250,000 per investment. Should the term deposit rates default, the asset management company will be required to pay the client back within 30 working days their total capital up to a value of $250,000 per investment. The profit on this investment is also covered in the event of liquidation or default of the bank.

- fake Citibank PDS

Unreasonably low or zero fees are another method used by scammers to make the scheme more appealing. This doesn’t always mean it’s a scam, but it should raise questions.

Example 1

Are there any management fees for this investment? No, we take our fees from project managers and government bodies. There will be no costs associated with taking this investment.

– fake Macquarie PDS

Example 2

Image of fake Westpac PDS

The FMA understands New Zealanders have been contacted by scammers after entering their contact details into a website operated by the scammers. Scammers will then follow up by calling or emailing. Other investors have been cold-called, another typical sign of a scam.

Scammers may use the names of genuine staff from providers, usually sourcing identities from LinkedIn. When direct email contact is established by the scammers, this will be from a non-genuine email domain.