-

Consumer

-

Investing

- Investing basics

-

Deciding how to invest

-

Ethical investing

-

Managing your investment

- Online investing platforms

-

Types of investments

-

Bank regulatory capital

-

Binary options

-

Bonds

-

Cash investments

-

Crowdfunding

-

Cryptocurrencies

-

Derivatives

-

Exchange-traded funds

-

Foreign exchange trading

-

Gold and other commodities

-

Investment software packages and seminars

-

Managed funds

-

Peer-to-peer lending

-

Property investment

-

Property syndicates

-

Shares

-

Wholesale investments

-

Bank regulatory capital

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

-

Unregistered businesses

-

Investing

-

Finance professionals

-

Services

-

Accredited bodies

-

Administrators of financial benchmarks

- Auditors

-

Authorised body under a financial advice provider licence

-

Client money or property services provider

-

Climate Reporting Entities (CREs)

-

Crowdfunding service providers

-

Crypto asset service providers

-

Directors

-

Derivatives issuers

-

Discretionary Investment Management Service (DIMS)

- Financial advice provider

-

Financial adviser

- Financial Institutions

- Financial market infrastructures

-

Independent trustees

-

Interposed persons under the financial advice regime

- Managed investment scheme manager

-

Market operators

-

Offer disclosure for equity and debt offers

- Offers of financial products

-

Peer-to-peer lending service providers

-

Supervisors

-

Accredited bodies

- Focus areas

- Legislation

-

Licensed & reporting entities

-

Online Services

-

Services

-

About

- People & leadership

-

Board

- Regulatory approach

- Enforcing the law

-

Investor capability

-

Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

-

When to contact us

-

Make a complaint

-

Official Information Act (OIA) requests

-

Make a protected disclosure (whistleblowing)

-

When to contact us

26 May 2023

Understanding the new climate-related disclosures regime

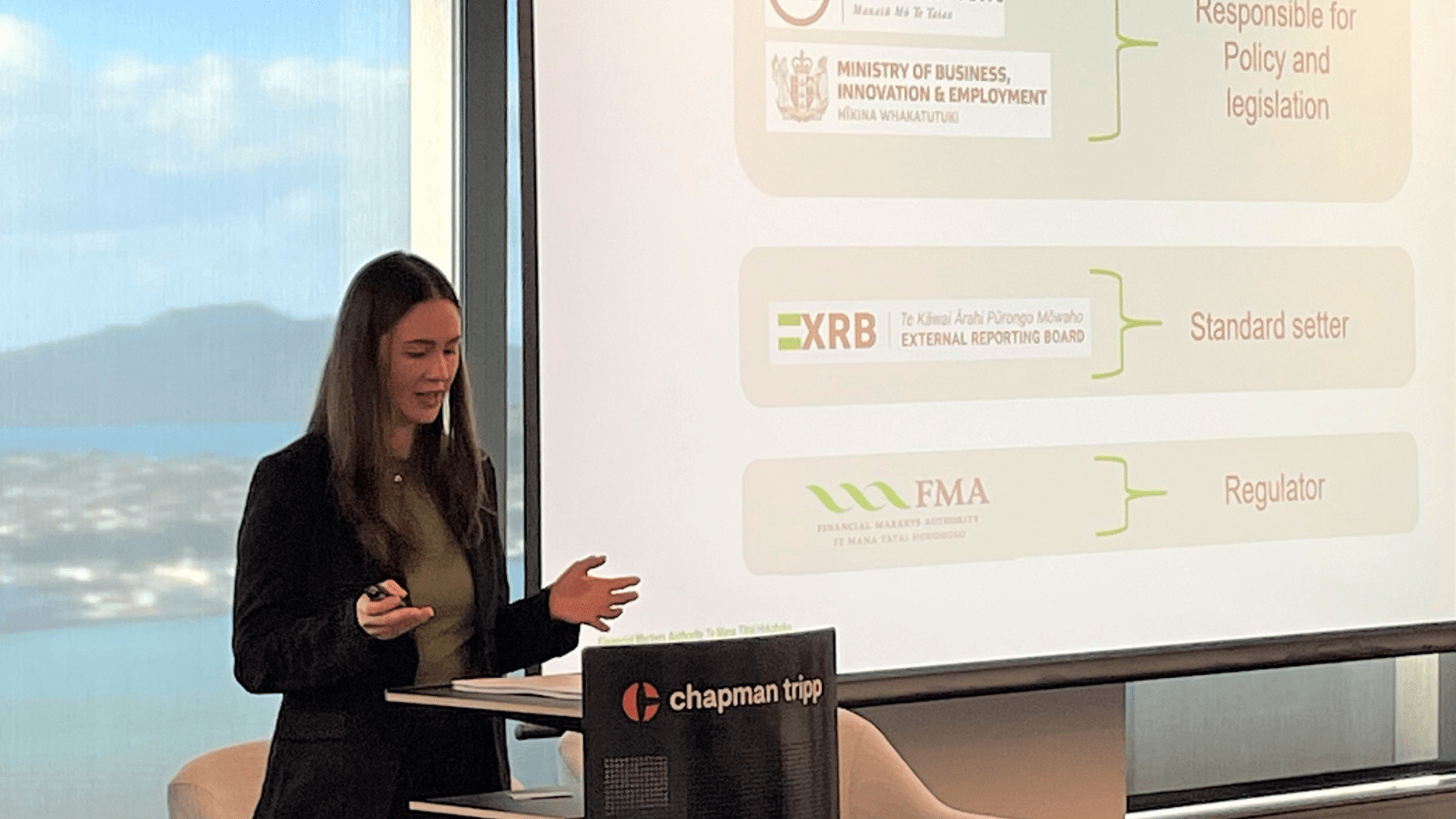

Don’t delay; start preparing for the new climate-related disclosures regime: That was the FMA’s key message to an Institute of Finance Professionals New Zealand (INFINZ) Masterclass in Auckland last week.

FMA’s Jenika Phipps, Manager, Climate-related Disclosures, gave the audience of CEOs, CFOs, Board members and Directors an overview of the FMA’s expectations and approach to monitoring for entities that fall under the new the climate-related disclosures regime. Jacco Moison, Head of Audit, Financial Reporting and Climate-related Disclosures, then talked about how climate impacts financial statements and audits, and what this might mean for directors.

Both emphasised the critical role that directors play in the successful implementation of the new regime. As well as ensuring their disclosures provide context, address material issues, and demonstrate transparency and consistency, directors need to ensure that they upskill themselves and that their organisation has put the necessary resources, processes and procedures in place to upskill their governance body and other teams. Jenika added: “This could include ensuring appropriate expertise is available to provide oversight and that the right people, internally and externally, are working together.”

The FMA is taking a broadly educative and constructive approach to the new regime, issuing high level guidance on compliance expectations, then moving to a proactive regulatory role as the regime becomes more established.

Educative and constructive approach

As the regulator, the FMA will monitor and enforce the new regime, provide guidance, and share feedback to improve the level of reporting over time. “Our role is to ensure that what Climate Reporting Entities (CREs) disclose can be substantiated,” explained Jenika. “It’s how the FMA can ensure the regime contributes to Aotearoa New Zealand’s transition to a more sustainable, low emissions economy.”

Four new pieces of guidance covering monitoring, third-party providers, record-keeping, and scenario analysis are due out in June and July 2023.

As the first climate statements are published in 2024, the FMA will support CREs to improve but will also take enforcement action where they fail to produce a climate statement or where information is false or misleading. There are criminal and civil (financial) penalties for those who don’t comply.

Jenika noted that adapting to the new record-keeping requirements will be a challenge for many entities. CREs must be able to prove what they report is true. To do this, they will need to determine what new climate-related data and information is required to substantiate the climate statements produced for their entity, and identify ways to collect, analyse and store it.

Jenika advised the audience to start preparing now: “This is a significant change. It may require more resources, new processes, and systems, and some upskilling across your organisation. Our advice is don’t delay. Start preparing now.”

Climate risk and financial statements

There are obligations for entity’s, regardless of whether they fall under the CRD regime, to determine whether climate has an impact on their financial statements and other communication, such as product disclosure statements.

Directors and management teams are responsible for ensuring financial statements comply with the Accounting Standards and that means including climate in their risk assessment processes if they are material.

Transparency is key as Jacco explained: “Entities may want to disclose how they have considered climate risk even if it didn’t have a material impact on their numbers. Users expect to see it and may wrongly assume it’s not been considered if it’s not disclosed.”

The FMA issued guidance for auditors on what it expects to see in audit files on material climate risks in October, which may also be useful for entities. From the 2023 reporting season, the FMA’s monitoring of financial reporting and audit quality reviews will include consideration of climate risks, and how these have been addressed, and its monitoring approach will ensure that climate-related disclosures are consistent across multiple documents including financial statements.