-

Consumer

-

Investing

- Investing basics

-

Deciding how to invest

-

Ethical investing

-

Managing your investment

- Online investing platforms

-

Types of investments

-

Bank regulatory capital

-

Binary options

-

Bonds

-

Cash investments

-

Crowdfunding

-

Cryptocurrencies

-

Derivatives

-

Exchange-traded funds

-

Foreign exchange trading

-

Gold and other commodities

-

Investment software packages and seminars

-

Managed funds

-

Peer-to-peer lending

-

Property investment

-

Property syndicates

-

Shares

-

Wholesale investments

-

Bank regulatory capital

- Getting advice

- Everyday finance

- KiwiSaver & Superannuation

-

Unregistered businesses

-

Investing

-

Finance professionals

-

Services

-

Accredited bodies

-

Administrators of financial benchmarks

- Auditors

-

Authorised body under a financial advice provider licence

-

Client money or property services provider

-

Climate Reporting Entities (CREs)

-

Crowdfunding service providers

-

Crypto asset service providers

-

Directors

-

Derivatives issuers

-

Discretionary Investment Management Service (DIMS)

- Financial advice provider

-

Financial adviser

- Financial Institutions

- Financial market infrastructures

-

Independent trustees

-

Interposed persons under the financial advice regime

- Managed investment scheme manager

-

Market operators

-

Offer disclosure for equity and debt offers

- Offers of financial products

-

Peer-to-peer lending service providers

-

Supervisors

-

Accredited bodies

- Focus areas

- Legislation

-

Licensed & reporting entities

-

Online Services

-

Services

-

About

- People & leadership

-

Board

- Regulatory approach

- Enforcing the law

-

Investor capability

-

Corporate publications

- Careers Document library

- News & Insights Document library

- Scams Document library

-

Contact

-

When to contact us

-

Make a complaint

-

Official Information Act (OIA) requests

-

Make a protected disclosure (whistleblowing)

-

When to contact us

16 June 2022

Update on the KiwiSaver default scheme provider change process

In May 2021, the Finance Minister and Minister of Finance and the Minister of Commerce and Consumer Affairs announced the 6 KiwiSaver providers who will offer default fund services from 1 December 2021.

The Financial Markets Authority (FMA) - Te Mana Tātai Hokohoko has published the below information to show the progress and conclusion of the transition.

The information refers only to ‘non-active default members’ - members who were allocated to a default fund and by the time of the transition (1 December 2021) had not made an active choice about their KiwiSaver provider. As some providers maintained their default status (BNZ, Booster, Westpac and Kiwi Wealth/Kiwibank), some members’ investments were only switched to a new fund within the same provider. Members whose provider no longer had default status were transferred to a new provider and switched to the new fund settings.

About the new default funds

The new settings mean KiwiSaver members in default schemes will pay lower fees across the duration of their investment and benefit from a balanced rather than a conservative risk profile, enhanced service levels, better member engagement and fossil fuel exclusions. The benefits of the changes were set out in a Ministerial media release at the time.

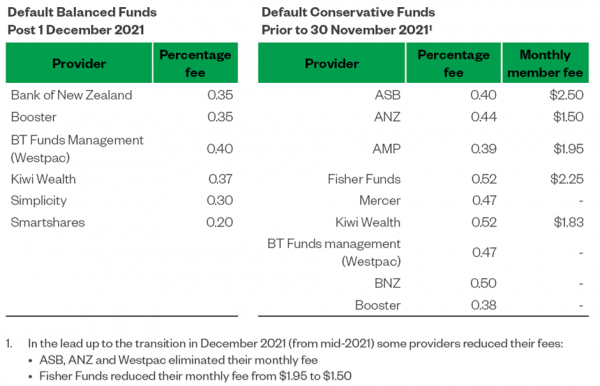

The tables below show the reductions in fees charged under the new default settings (and note none of the new default funds charge a member fee).

¹ Note: In the lead up to the transition in December 2021 (from mid-2021) some providers reduced their fees:

- ASB, ANZ and Westpac eliminated their monthly fee

- Fisher Funds reduced their monthly fee from $1.95 to $1.50

Reconciling default members and funds under management (FUM)

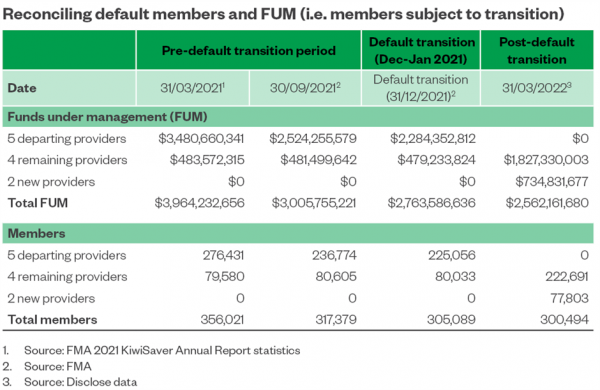

The data shows an orderly transition of 305,089 KiwiSaver default members and nearly $2.8 billion in assets (the total of all switched and transferred balances), due to a competent, collective effort by default providers and the Financial Services Council, overseen and coordinated by Inland Revenue, MBIE and the FMA.

The change in the number of members from 356,021 in March 2021 to 305,089 in December 2021 can be attributed to:

- Transfer communications from providers, IRD, Government announcements and media coverage - all of which contributed to a section of the default members who had been previously unengaged now being encouraged to connect with their provider, and many choosing to stay where they were. This ‘active choice’ made them ineligible for the transition;

- The IRD transformation project meant providers had more contact points available for previously hard-to-contact members, and;

- Widespread reductions, and some eliminations, of fees among the outgoing providers through 2021 but in particular following the publication of the FMA’s value for money guidance in April 2021. As such, members choosing to remain with outgoing providers are still very likely to have benefitted anyway from lower fees.

FMA monitoring, post-transition, will shift to default reporting requirements. This will include how attractive the settings of the new default funds are proving to active choice members – acknowledging the default funds were specifically designed to be open to all members.

Costs of the transition

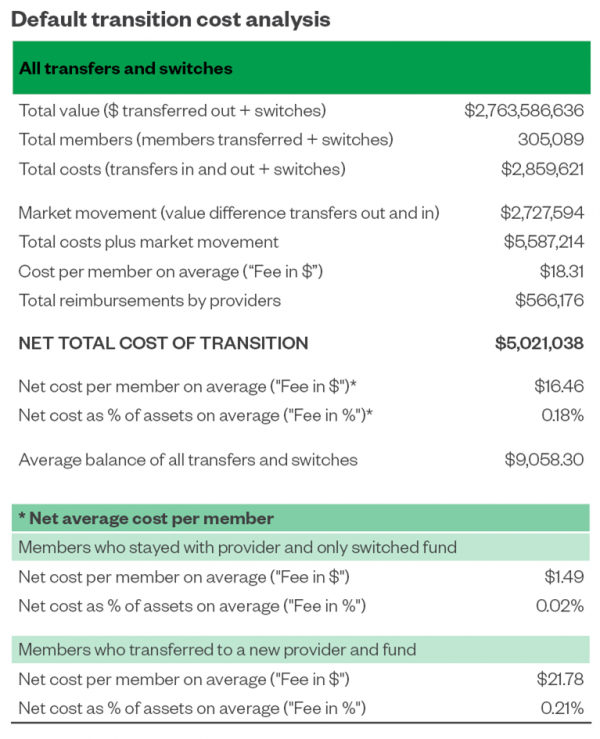

The costs of the transition itself were minimal, particularly viewed relative to the long-term benefit of being in a balanced rather than a conservative risk profile, lower fees, fossil fuel exclusions and enhanced member engagement requirements.

The total cost of just under $5.6 million (arising from transaction costs and market movement) was offset by many of the providers choosing to reimburse $566,000 of the cost of transfers and switches. This resulted in a final, average cost to each transitioned member of $16.46 per member or 0.18% of the average transitioned balance of $9,058.30 (both transfers between providers and switches within continuing providers).

This is a one-off cost set against the longer-term benefit of lower fees, and exposure in a Balanced risk setting to a higher level of growth assets, which is expected to deliver higher balances over time, when compared to the previous Conservative risk settings.

None of the new funds charge a monthly membership fee, which under the old funds ranged from $18 a year to $27 a year (where charged and taking into account the fee changes referred to in the above footnote).